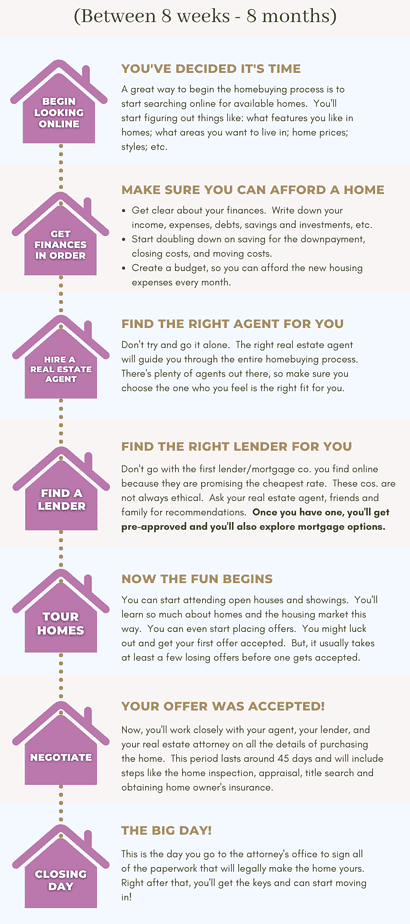

It takes anywhere from 8 weeks to 8 months to buy a home from start to finish. Factors such as how soon you need to move, how prepared you are, what your financial situation is like, and what the current housing market is like in your area will all determine your timeline. Speed up the process by having your finances in order and plenty of money saved for the down payment, closing costs, and moving costs.

Buying your first home is such a huge and exciting undertaking, it’s natural to want to know how long the whole process will take. Unfortunately, it’s anyone’s guess.

If you’ve let friends and family members in on your plans, you most likely have heard different stories by now.

A friend of yours might have bragged that she found the perfect home right away; her offer was accepted over ten others; and she was easily able to move in a few weeks later.

Another friend might be telling you horror stories of rundown homes, awful competition, and offer after offer getting rejected for over two years until he finally lucked out.

Usually, the homebuying process is somewhere in between these two extreme cases.

In this blog post, we’ll go over the typical timeline, including the basic stages along the way.

Stage 1: You’ve Decided it’s Time to Buy Your First Home

There’s many reasons for this, but you have figured out that you’re ready.

This is the time when most people head online to start searching for homes. You’ll learn a lot about the housing market this way, including home prices, sizes, styles, etc.

While you’re at it, this is a good time to start reading blog posts like this one – so you can begin learning about the housing market in general.

There’s plenty of articles here at Buying Your New Home that can teach you all sorts of things about the homebuying process.

Stage 2: Get Your Finances in Order

You need to make sure you can afford a home.

Since buying a home is a ginormous purchase, often the biggest purchase of a person’s life, you don’t want to go into it guessing about your finances.

Here are four things you can do to prepare financially for buying a home:

1 Write All of Your Finances Down

You might choose to use a program such as Mint for personal finance instead of old fashioned pen and paper. Just make sure you include everything.

That way you’ll know exactly:

- What money is coming in every month as income

- What money is going out every month as expenses

- What your debts are – such as credit cards, car loans and student loans

- What your assets are – such as savings, investments and 401k’s

- What you have saved for the down payment, closing costs and moving costs

2 Work on Your Credit Score

Order your credit score and credit report from one of the three reporting agencies. Then go through the report to see how you can improve it.

The higher your credit score the better position you are in to obtain a mortgage.

A higher score also means a better mortgage rate, which translates to lower monthly payments.

3 Create a Budget

You’re going to also want to create a budget to make sure you can afford all the new expenses every month that go along with owning your own home.

Are you paying rent now? Then the mortgage payments might not be a huge shock to your financial system.

But if not – if you’ve been living at home for example – that new payment every month will drastically change your money flow every month.

Include in this budget everything you pay for now and all the things you can think of that you’ll need to pay for as a homeowner.

It’s ok if it’s not perfect. A budget is a work in progress that you can keep adding to and tweaking as you go along.

4 Double-Down on Saving for the Down Payment

The more money you put down on a house, the better.

There are down payment assistance programs and some types of mortgages that require little or no down payment. But, you might not qualify for them.

And you will still need to have plenty of money saved up for all the expenses that go into buying a home.

Having as large of a down payment as you can generally means your mortgage will be smaller and your monthly mortgage payments will be less.

It can also mean the difference between losing and winning offers.

Showing the seller in your offer that you are capable of placing a large down payment usually shows them that you are a strong and serious buyer. It can be a huge advantage over your competition.

Stage 3: Find the Right Real Estate Agent

A good real estate agent will guide you through the entire home buying process.

There’s plenty of agents out there, so make sure you choose the one who you feel is the right fit for you.

We have an article here at Buying Your New Home that shows you the exact ways of finding good real estate agents.

Stage 4: Find the Right Lender

Speaking of articles, we have an excellent one on finding good lenders and mortgage companies.

Just beware of shady lenders and mortgage companies! There are plenty of them out there.

For instance, don’t go with the first lender/mortgage co. you find online because they are promising the cheapest rate. They’ll usually make up for these cheap rates with hidden fees that you never find out about.

Ask your real estate agent, friends and family for recommendations.

Once you’ve found a good lender, you’ll get pre-approved and you’ll also explore mortgage options.

The Pre-Approval

Before you move onto the next stage, make sure you get pre-approved with your lender.

The two main reasons why you need a pre-approval are:

- It lets you know you’re able to get a mortgage and for up to how much.

- It lets sellers know that you are able to get a mortgage. (You’ll include a pre-approval letter with each offer you place on a home.)

The lender will essentially check your credit; your income and expenses; your debts; and your assets. This will require you providing him or her with plenty of paperwork they’ll need.

Then, depending on how fast you get them all the documents, they’ll be able to get you pre-approved in a matter of a few hours to a few days.

The pre-approval will basically let you know that you are able to obtain a mortgage; what the terms will be; and how much house you can afford.

Knowing how much house you can afford is so important. That way, you won’t start wasting your time looking at homes above your budget.

Your lender will also write a pre-approval letter that you’ll include with offers on homes. This lets the seller know that you are capable of getting approved for a mortgage to purchase the home.

Stage 5: Tour Homes

This is when the real fun begins.

You can start attending open houses and showings to see homes upfront. You’ll learn so much about homes and about the housing market this way.

An open house is usually held on a Saturday early afternoon by the listing agent who is selling a house. They’ll open the doors to the home to the general public and to agents. You can basically walk right into these open houses – with or without your real estate agent.

A showing is when you tour a home with just you and your real estate agent.

If you’ve been pre-approved, you can start placing offers.

Your agent will guide you through the entire process of placing good, competitive offers.

You might luck out and get your first offer accepted. But, it usually takes at least a few losing offers before that happens.

It’s an exciting time right now that can sometimes be described as a roller coaster.

You find a home you love, for example; place an offer with high hopes of being able to call it your own; only to be let down by your offer getting rejected. Then back up again when you see another great house.

The best advice is to just go with the flow and enjoy the process as much as you can.

How often in your life do you get to bid on something as huge as a new home?

Sure, there will be ups and downs, obstacles, and complications. But, if you stay strong and positive – and confident that you will find an amazing home – this will all go a long way to making this whole time fun and memorable.

Stage 6: Your Offer Was Accepted!

Congrats! Now you’ll move on to the negotiation period.

First, you’ll be negotiating through your real estate agent to get the best price and conditions you can on the home.

Both your agent and the seller’s agent will be going back and forth during this time compromising on behalf of each client.

Included in this phase is the home inspection. (Unless you’ve chosen to waive it, which I don’t recommend.)

Once the home inspection is over and those negotiations are completed, it’ll be time to hire a real estate lawyer to help you work on the details of the Purchase and Sale Agreement.

Your real estate agent will provide you with names of lawyers they recommend.

So, essentially you’ll be working closely with your ‘dream team’ over the next several weeks to get you to the finish line: closing on (purchasing) your house and moving in!

Your dream team essentially consists of your real estate agent, your lender, and your real estate lawyer.

This period lasts around 45 days and will include things like the appraisal, title search, the mortgage underwriting and you obtaining homeowners insurance.

Stage 7: Closing Day and Moving In!

This is the day you’ll go to the attorney’s office and sign all the paperwork that legally makes the home yours.

Right after that, you’ll get the keys and can start moving in!

Now, that you have the basics down, here are some factors that can affect how fast or slow the entire homebuying process could take you.

Factors That Can Affect the Timeline

Here are just a few circumstances that could delay, slow down or possibly speed up your homebuying process.

Your Personal Circumstances

This could range from things like: your family is growing; or you just got married; to you just got accepted for a job several towns or states away.

Your Housing Circumstances

Do you need to vacate your apartment soon? You might try and speed up the homebuying process then.

Or you might have a lease you’d rather not break, so you are not in a huge rush to purchase a home.

Maybe you’re still living at home rent free. And even though you’re anxious to be on your own, this is a pretty cushy situation. So you might not be in the biggest rush to start paying a mortgage every month.

On the other hand if you are paying rent – with the way rent prices have skyrocketed in the past several years, your rent might be ‘bleeding you dry’ every month. So, finding a home as soon as you can is important.

Your Financial Circumstances

You might have made some poor financial decisions that you didn’t give much thought to before.

But, now your credit score is too low to get pre-approved for a mortgage.

This happens. Don’t beat yourself up about it! Tomorrow’s a new day to start fresh, as they say.

But, this will also mean you have to put your homebuying plans on hold while you work on paying down debt and improving your credit score.

Not having the money saved for a down payment, closing expenses, and moving expenses is another reason why you might have to wait to begin your home search.

On the other hand, if you have an excellent credit score and a huge down payment saved, you might be able to actually speed up the entire process.

Another thing that can really speed up the process is to have your finances and all of your documents organized. Like bank accounts, pay stubs, W-2’s, tax records, etc.

Even if they aren’t organized yet, when the lender asks you for everything – dig it all up as fast as you can.

Some people are so overwhelmed when they have to get the lender all their documentation that they’ll put off their homebuying plans. Don’t let this happen to you.

The Current Housing Market

The housing market nationally and in your particular area can affect how long it takes for you to land your first home.

For instance, the country has been experiencing a housing shortage for years. So, basically there’s not enough homes to go around.

This is one of the reasons why ten people can be placing offers on the same house. In fact, in these past few years, it was not uncommon to have 10 offers on one home.

As of writing this we’re also still in a seller’s market, which means home sellers have all the advantages over home buyers.

In a buyer’s market, there are more homes for sale than there are buyers. We haven’t experienced this type of market in years now.

On top of this, interest rates are higher than they have been in the past few years and home prices are not going down anytime soon.

All these factors could mean that the homebuying process could take longer for you.

The Seller’s Needs

Once your offer is accepted, how fast or slow it takes you to close on the home is also affected by the seller’s circumstances.

For instance, the seller might need extra time to find a new house. Or they might ask if you can close sooner than normal. Something you’ll have to check with your lender about.

As you can see, the timeline for buying a house can vary a lot depending on all kinds of factors.

The best thing to do is be ready to act quickly on a house you like; get ready to negotiate; and then be extremely cooperative and patient over the next several weeks – until you finally get to call the house your own.

Enjoy!

Get the FREE 14 page E-Book 10 Smart Ways to Get Approved for Your First Mortgage. And you’ll start getting our newsletters with tips and advice.

Stay tuned for more articles on all the ins and outs of home buying for first-time homebuyers.

If you’d like to ask me any questions, email me anytime at: paula@michaelandsullivan.com.

Or call: 774-287-5852

Paula